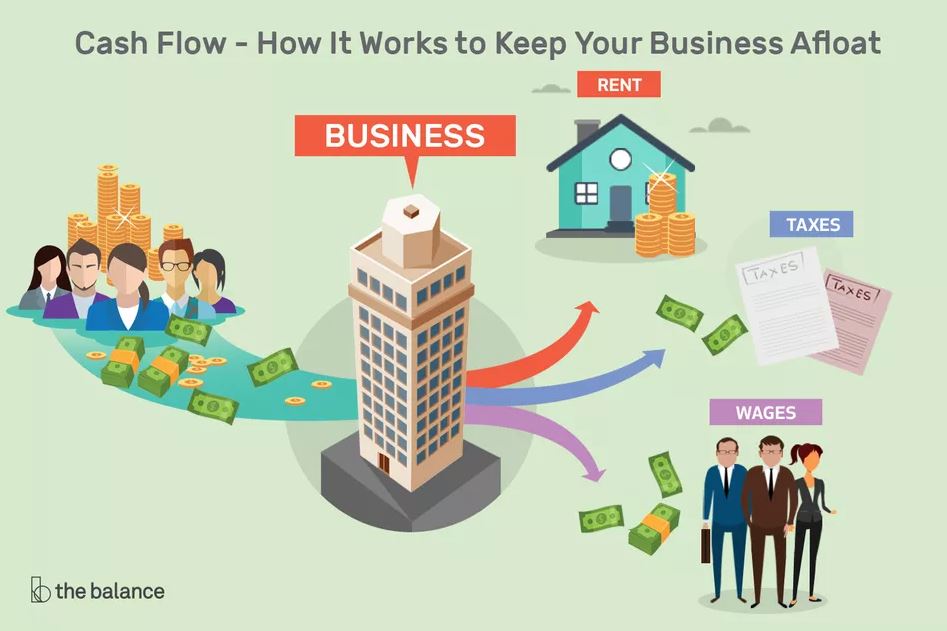

Cash flow is the money that is moving (flowing) in and out of your business in a month. Although it does seem sometimes that cash flow only goes one way – out of the business – it does flow both ways.

- Cash is coming in from customers or clients who are buying your products or services. If customers don’t pay at the time of purchase, some of your cash flow is coming from collections of accounts receivable.

- Cash is going out of your business in the form of payments for expenses, like rent or a mortgage, in monthly loan payments, and in payments for taxes and other accounts payable.

Cash Flow Help During the Coronavirus Disaster

Several forms of coronavirus relief are available to small businesses affected by the coronavirus:

Cash vs. Real Cash

For some businesses, like restaurants and some retailers, cash is really cash – currency and paper money. The business takes cash from customers and sometimes pays its bills in cash. Cash businesses have a special issue with keeping track of cash flow, especially since they may not track income unless there are invoices or other paperwork.

Why Cash Flow is So Important

Lack of cash is one of the biggest reasons small businesses fail.

The Small Business Administration says that “inadequate cash reserves” are a top reason startups don’t succeed. It’s called “running out of money,” and it will shut you down faster than anything else.

Starting a Business: Dealing with cash flow issues is most difficult when you are starting a business. You have many expenses and money is going out fast. And you may have no sales or customers who are paying you. You will need some other temporary sources of cash, like through a temporary line of credit, to get you going and on to a positive cash flow situation.

The first six months of a business is a crucial time for cash flow. If you don’t have enough cash to carry you through this time, your chances for success aren’t good. Suppliers often won’t give credit to new businesses, and your customers may want to pay on credit, giving you a “cash crunch” to deal with.

Seasonal Business: Cash flow is particularly important for seasonal businesses – those that have a large fluctuation of business at different times of the year, like holiday businesses and summer businesses. Managing cash flow in this type of business is tricky, but it can be done, with diligence.

Cash Vs. Profit: It’s possible for your business to make a profit, but have no cash. How can that happen? The short answer is that profit is an accounting concept, while cash, as noted above, is the amount in the business checking account. Profit doesn’t pay the bills. You can have assets, like accounts receivable (money owed to you by customers) but if you can’t collect on what’s owed, you won’t have cash.

Tips for Managing Your Cash Flow

Here are some ways to better manage your cash flow to avoid a cash flow emergency:

Control inventory. Having too much inventory ties up cash. Keep track of inventory so you can estimate your needs better.

Collect receivables. Set up a collections schedule, using an accounts receivable aging report as a guide. Follow up on non-payers.

End Unprofitable Relationships. Decide when it’s time to end a relationship with someone who never pays

Using a Cash Flow Statement

The best way to keep track of cash flow in your business is to run a cash flow report. This report shows the cash you received and the cash paid out to show your business’s cash position at the end of every month.

For example:

- What happens to cash if a customer pays a bill?

- What happens to cash if your business buys supplies?

- What happens to cash if you buy a computer?

- What happens to cash if you pay an employee or an independent contractor?

At times, you may need to keep track of cash flow on a weekly, maybe even a daily basis. To dig deeper into this tip:

- At the end of this month, look at your total sales.

- Add up the purchases you have made that still need to be paid for.

- The difference is what you will need to bring in as income to stay even.

If this monthly cash shortage continues for several months, you’ll get further and further behind.

Four Easy Ways to Get a Cash Flow Statement

- This article by SCORE has a template for a 12 Month Cash Flow Statement.

- A quick and easy way to perform a cash flow analysis is to compare your total unpaid purchases to the total sales due at the end of each month. If the total unpaid purchases are greater than the total sales due, you’ll need to spend more cash than you receive in the next month, indicating a potential cash-flow problem.

- Your accounting software should have a cash flow statement as one of the standard reports, or your accountant can run it for you.9

- Read about Free Cash Flow as an indicator of your overall business health, and how to calculate it.

If you have time to do only ONE business analysis every month, make it a Cash Flow Statement to keep track of your cash position.

Getting Temporary Cash Flow Help

Many businesses get help with temporary cash flow shortages by setting up a working capital line of credit. A business credit line for working capital works in a different way from a loan.

When you get a credit line, you have a certain amount of credit in an account that you can draw on when you are short of cash and pay back on when you have extra cash. You only pay interest charges on the amount taken out. For example, if you have a $25,000 line of credit, and you have taken out $10,000, you would only pay interest on the $10,000.

Written by Jean Murray for TheBalance